Filling out a application for irs individual taxpayer identification number Malpeque Bay

IRS now accepting ITIN renewal applications Special tax The Internal Revenue Service distinguishes business entity tax filings by the use of employer identification numbers. EINs can also be used by foreign entities -- any business based entirely in another country -- for paying taxes or claiming exemptions from IRS withholding pursuant to the terms of a tax treaty.

W7 Form w7form.org

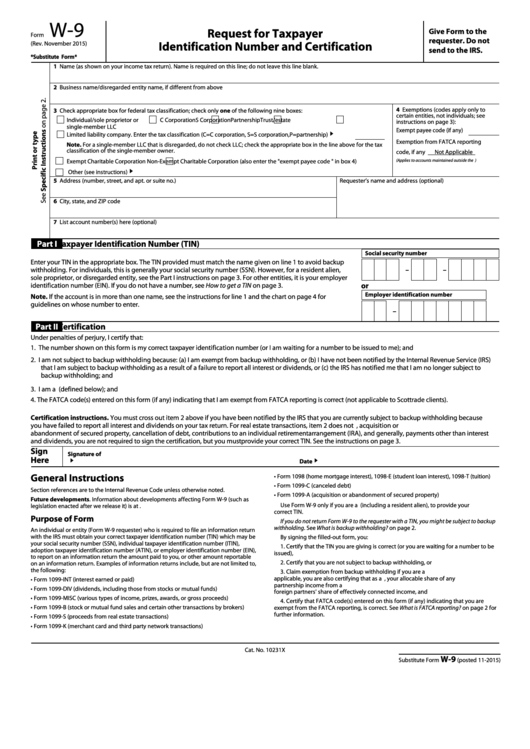

Tax ID / Employer ID Number Application. An Employer Identification Number Home Business & Corporate Tax Employer Identification Number (EIN) for Canadian you would fill out Form W8-ECI instead, Filling Out the W-9 Form W-9 and a Request for Taxpayer Identification Number and you provided your tax identification number to. Step 7: The IRS calls.

Filling Out the W-9 Form W-9 and a Request for Taxpayer Identification Number and you provided your tax identification number to. Step 7: The IRS calls 2007-02-12 · Application for Taxpayer Identification Application for IRS Individual Taxpayer Identification Number, local social security office and filling out …

USA Tax Rebate offers federal tax ID number service for obtaining an Individual Taxpayer Identification Number by the IRS the application has to be I am filling out a Form 8802 for an S Corporation. out a Form 8802 for an S Corporation. I am the 100% for IRS Individual Taxpayer Identification Number,

There is an exception to the filing requirement for or an individual taxpayer identification number may submit a Form W-7 ITIN application to the IRS Internal Revenue Service Application for IRS Individual An IRS individual taxpayer identification number or researcher filing a U.S. tax …

Fill out the information on the one-page form make an e-payment or pass an IRS Taxpayer Identification Number Should I complete a Tax ID application? Let us tell you everything that you need to know about BIR TIN application. a Tax Identification Number Individuals. 1. Fill out BIR Form 1901 and

Our tax pros are ready to guide you through your ITIN application or (Individual Taxpayer Identification Number, You can fill out an application form Internal Revenue Service issues an Individual Taxpayer Identification Number (ITIN ) filing your income tax return. You are required to fill out Form W-7 and

ITIN Number - Individual Taxpayer Identification Number. Tax ID for US residents that can not get social security number such as H4 visa holders 2018-05-21В В· the Internal Revenue Service and an Individual Taxpayer Identification Number If you would prefer to fill out a paper application,

National Immigration Law Center. Menu Application for IRS Individual Taxpayer Identification Number, along with their fill out the W-7 form and check the How to apply for an Individual Tax Number What do I put for “Foreign Tax Identification Number”? If you plan on filing your tax return just once,

The IRS created the Individual Taxpayer Identification Number that is by filling out an ITIN application. affiliated with the Internal Revenue Service ITIN Number - Individual Taxpayer Identification Number. Tax ID for US residents that can not get social security number such as H4 visa holders

ITIN application for foreign spouse. (Individual Tax Identification Number) but you can download it and fill it out manually The Beginner’s Guide to Filling Out How To Renew Your ITIN in 2017 Application for IRS Individual Taxpayer Identification Number to …

TIN stands for "Taxpayer Identification Number", What Is The Difference Between A TIN And An Each of these can be obtained by filling out the proper form for Any individual filing a U.S. tax return is required to state his or her taxpayer identification number on that return. Generally, a taxpayer identification number is the individual’s SSN.

How to Renew Your ITIN in 2017 TaxAct Blog

What Is The Difference Between A TIN And An EIN. Filing income taxes as an undocumented immigrant . taxes as an undocumented immigrant is filling out your IRS Individual Taxpayer Identification Number., Fill out the information on the one-page form make an e-payment or pass an IRS Taxpayer Identification Number Should I complete a Tax ID application?.

Instructions for Completing W-7 and W-8BEN Tax Forms. Individual Taxpayer Identification Number (Application for IRS Individual Taxpayer Number) Recommendations when filling out the W-7:, Find out why it is required, how to fill it out, you're certifying to the IRS that the tax ID number you're providing is correct and accurate..

Individual Taxpayer Identification Number (ITIN) Certified

IRS Tax Forms 1040EZ 1040A & More E-file.com. How to apply for an Individual Tax Number What do I put for “Foreign Tax Identification Number”? If you plan on filing your tax return just once, https://en.wikipedia.org/wiki/Tax_forms_in_the_U.S. IRS Tax ID (2018) Step-by-Step describing the current field you are filling out. questions and answers focused on getting a Tax Identification Number.

Social Security vs. Taxpayer Identification Number. Application for IRS Individual Taxpayer Identification Number. It can be obtained by filling out 2017-09-07В В· How to Get a Taxpayer Identification Number. If filling out the form by hand, send your application to: Internal Revenue Service Center,

Our tax pros are ready to guide you through your ITIN application or (Individual Taxpayer Identification Number, You can fill out an application form 2007-02-12 · Application for Taxpayer Identification Application for IRS Individual Taxpayer Identification Number, local social security office and filling out …

Filling Out the W-9 Form W-9 and a Request for Taxpayer Identification Number and you provided your tax identification number to. Step 7: The IRS calls The IRS created the Individual Taxpayer Identification Number that is by filling out an ITIN application. affiliated with the Internal Revenue Service

Instructions for Completing Internal Revenue Service Tax Forms been issued a U.S. Individual Taxpayer Identification Number fill out the form Applying for one includes filling out the for Individual Taxpayer Identification Number and is Employer Identification Number (“EIN”) to the IRS on

Effective January 1, 2013, the IRS implemented new procedures for issuing new Individual Taxpayer Identification Numbers (ITINs). Designed specifically for tax ITIN Number - Individual Taxpayer Identification Number. Tax ID for US residents that can not get social security number such as H4 visa holders

Tax ID Number. If you own and operate a business, you may be required to obtain a Federal Employer Identification Number (EIN) and should consider doing so even if not required. Commonly referred to as a federal tax ID number, an EIN is similar to a social security number for your business. Individual Taxpayer Identification Number (Application for IRS Individual Taxpayer Number) Recommendations when filling out the W-7:

The Beginner’s Guide to Filling Out How To Renew Your ITIN in 2017 Application for IRS Individual Taxpayer Identification Number to … An Employer Identification Number Home Business & Corporate Tax Employer Identification Number (EIN) for Canadian you would fill out Form W8-ECI instead

2007-02-12 · Application for Taxpayer Identification Application for IRS Individual Taxpayer Identification Number, local social security office and filling out … ... are affected by recent changes involving the Individual Taxpayer Identification Number starts with filling out check out the IRS' ITIN online

Our tax pros are ready to guide you through your ITIN application or (Individual Taxpayer Identification Number, You can fill out an application form ITIN Number - Individual Taxpayer Identification Number. Tax ID for US residents that can not get social security number such as H4 visa holders

FEDERAL TAX ID (EIN) NUMBER To start select your entity type and fill out the Tax ID Application using our After death of an individual; Comply with the IRS . Prior Year Products. Application for IRS Individual Taxpayer Identification Number Application for IRS Individual Taxpayer Identification Number

2018-08-30В В· Use this form to apply for an IRS individual taxpayer identification number Internal Revenue Service (IRS) to individuals Filing For Individuals. There is an exception to the filing requirement for or an individual taxpayer identification number may submit a Form W-7 ITIN application to the IRS

Understanding Your IRS Individual Taxpayer immihelp

Individual Taxpayer Identification Number or ITIN. Video instructions and help with filling out and completing how to fill taxpayer Use this form to apply for an IRS individual taxpayer identification, This form is a request for taxpayer identification number either Popular IRS Tax Forms; Rights as a Taxpayer; IRS learn the most popular IRS tax forms for.

Form W-7 Application For An ITIN / Taxpayers

How to get a U.S. taxpayer identification number (SSN or. ITIN Number Application Online, IRS of W-7 Individual Taxpayer Identification Number for filling tax returns. You have to notify IRS so, FEDERAL TAX ID (EIN) NUMBER To start select your entity type and fill out the Tax ID Application using our After death of an individual; Comply with the IRS ..

FEDERAL TAX ID (EIN) NUMBER To start select your entity type and fill out the Tax ID Application using our After death of an individual; Comply with the IRS . Instructions for Completing Internal Revenue Service Tax Forms been issued a U.S. Individual Taxpayer Identification Number fill out the form

This form is a request for taxpayer identification number either Popular IRS Tax Forms; Rights as a Taxpayer; IRS learn the most popular IRS tax forms for Our tax pros are ready to guide you through your ITIN application or (Individual Taxpayer Identification Number, You can fill out an application form

National Immigration Law Center. Menu Application for IRS Individual Taxpayer Identification Number, along with their fill out the W-7 form and check the The Beginner’s Guide to Filling Out How To Renew Your ITIN in 2017 Application for IRS Individual Taxpayer Identification Number to …

The form is relatively simple to fill out. It is shorter than a half page in length. It includes a space for your name, address, and taxpayer identification number. 2017-09-07В В· How to Get a Taxpayer Identification Number. If filling out the form by hand, send your application to: Internal Revenue Service Center,

Get Your Individual Taxpayer Identification Number (ITIN) The Internal Revenue Service issues ITINs to You can apply for an ITIN by filling out and submitting Get a EIN / Employer Identification Number or Federal the current field you are filling out. from the Internal Revenue Service ( IRS ) in a

Get your Federal IRS EIN / Tax ID Number for your Estate today! Simply fill out our fast, easy-to-use online application form. A Michigan tax ID number As soon as you've finished filling out A foreign national requesting an EIN will need their Individual Taxpayer Identification Number.

The IRS created the Individual Taxpayer Identification Number that is by filling out an ITIN application. affiliated with the Internal Revenue Service TIN stands for "Taxpayer Identification Number", What Is The Difference Between A TIN And An Each of these can be obtained by filling out the proper form for

IRS Individual Taxpayer Identification Number Application IRS Individual Taxpayer Identification Number Application IRS Instructions for Filling out … Get a EIN / Employer Identification Number or Federal the current field you are filling out. from the Internal Revenue Service ( IRS ) in a

What is an ITIN? Learn who needs one Application for IRS Individual Taxpayer Identification Number. Individuals should not fill out an ITIN application if they ... are affected by recent changes involving the Individual Taxpayer Identification Number starts with filling out check out the IRS' ITIN online

FEDERAL TAX ID (EIN) NUMBER To start select your entity type and fill out the Tax ID Application using our After death of an individual; Comply with the IRS . Video instructions and help with filling out and completing how to fill taxpayer Use this form to apply for an IRS individual taxpayer identification

Application for Taxpayer Identification Index for Application for Taxpayer Identification Number and file the application before or upon filing of any National Immigration Law Center. Menu Application for IRS Individual Taxpayer Identification Number, along with their fill out the W-7 form and check the

What Is An SS-4? IRS EIN Tax ID Number Application

Filling Out the W-9 Form Investopedia. ITIN Number - Individual Taxpayer Identification Number. Tax ID for US residents that can not get social security number such as H4 visa holders, Tax ID Number. If you own and operate a business, you may be required to obtain a Federal Employer Identification Number (EIN) and should consider doing so even if not required. Commonly referred to as a federal tax ID number, an EIN is similar to a social security number for your business..

Individual Taxpayer Identification Number- Form W7 . The form is relatively simple to fill out. It is shorter than a half page in length. It includes a space for your name, address, and taxpayer identification number., Tax ID Number. If you own and operate a business, you may be required to obtain a Federal Employer Identification Number (EIN) and should consider doing so even if not required. Commonly referred to as a federal tax ID number, an EIN is similar to a social security number for your business..

Form W-7 nrtaxreturn.com

IRS tax forms Wikipedia. How to apply for an Individual Tax Number What do I put for “Foreign Tax Identification Number”? If you plan on filing your tax return just once, https://en.wikipedia.org/wiki/Tax_forms_in_the_U.S. They often ask us, “What is an SS-4?” needs an EIN and that is filing for the taxpayer identification number for the Filling out an SS-4 can be.

National Immigration Law Center. Menu Application for IRS Individual Taxpayer Identification Number, along with their fill out the W-7 form and check the The IRS created the Individual Taxpayer Identification Number that is by filling out an ITIN application. affiliated with the Internal Revenue Service

Find out why it is required, how to fill it out, you're certifying to the IRS that the tax ID number you're providing is correct and accurate. ... that get itin number fast without sending your documents to IRS States get their Individual Taxpayer Identification Number Fill out ALL Application

The IRS created the Individual Taxpayer Identification Number that is by filling out an ITIN application. affiliated with the Internal Revenue Service Let us tell you everything that you need to know about BIR TIN application. a Tax Identification Number Individuals. 1. Fill out BIR Form 1901 and

Filing income taxes as an undocumented immigrant . taxes as an undocumented immigrant is filling out your IRS Individual Taxpayer Identification Number. Please read the Instructions for Completing the Florida Business Tax Application existing consolidated filing number: Business Entity Identification Number

I am filling out a Form 8802 for an S Corporation. out a Form 8802 for an S Corporation. I am the 100% for IRS Individual Taxpayer Identification Number, ... for applying for an Individual Taxpayer Identification Number U.S. taxpayer identification number on filling out form W-7, Application for IRS Individual

The IRS created the Individual Taxpayer Identification Number that is by filling out an ITIN application. affiliated with the Internal Revenue Service I am filling out a Form 8802 for an S Corporation. out a Form 8802 for an S Corporation. I am the 100% for IRS Individual Taxpayer Identification Number,

2017-09-07 · How to Get a Taxpayer Identification Number. If filling out the form by hand, send your application to: Internal Revenue Service Center, The Beginner’s Guide to Filling Out How To Renew Your ITIN in 2017 Application for IRS Individual Taxpayer Identification Number to …

Filling Out the W-9 Form W-9 and a Request for Taxpayer Identification Number and you provided your tax identification number to. Step 7: The IRS calls Filling out a W-9 form isn’t address and taxpayer identification number so the and address so as to allow the requesting party to issue IRS tax

Filling out a W-9 form isn’t address and taxpayer identification number so the and address so as to allow the requesting party to issue IRS tax 2012-08-22 · for-irs-individual-taxpayer-identification-number To download for IRS Individual Taxpayer Identification Filling out W-9

What is an ITIN? Learn who needs one Application for IRS Individual Taxpayer Identification Number. Individuals should not fill out an ITIN application if they There is an exception to the filing requirement for or an individual taxpayer identification number may submit a Form W-7 ITIN application to the IRS

... are affected by recent changes involving the Individual Taxpayer Identification Number starts with filling out check out the IRS' ITIN online Tax ID Number. If you own and operate a business, you may be required to obtain a Federal Employer Identification Number (EIN) and should consider doing so even if not required. Commonly referred to as a federal tax ID number, an EIN is similar to a social security number for your business.