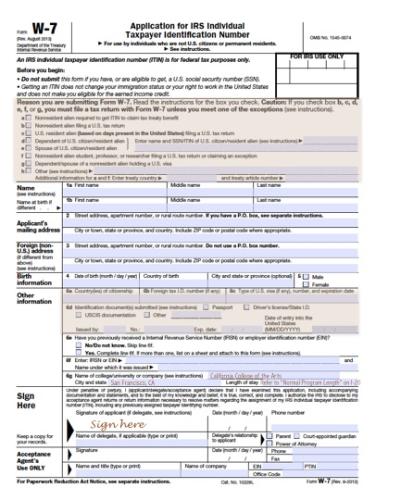

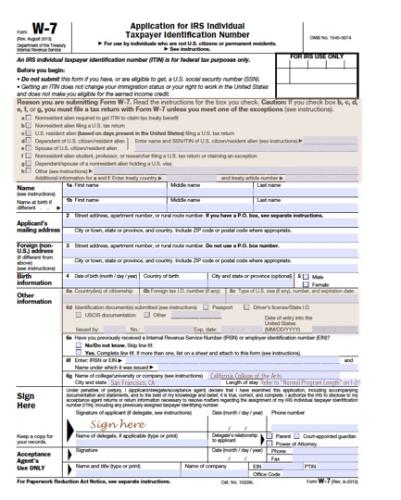

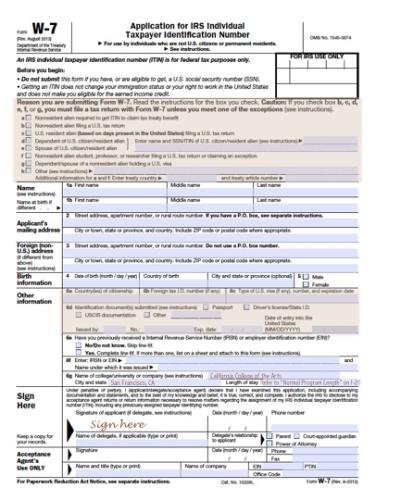

The IRS is Now Accepting ITIN Renewal Applications 2018-08-30В В· Use this form to apply for an IRS individual taxpayer identification number form to renew an existing ITIN that is Form W-7, Application for IRS

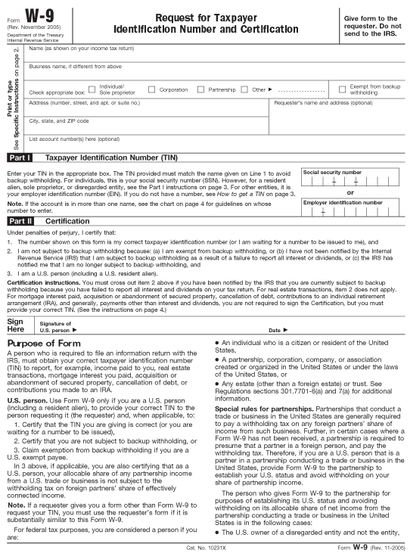

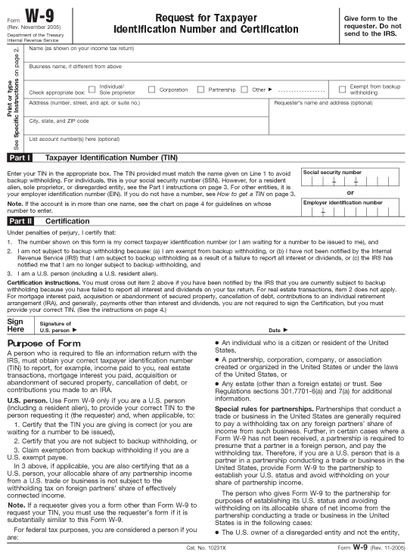

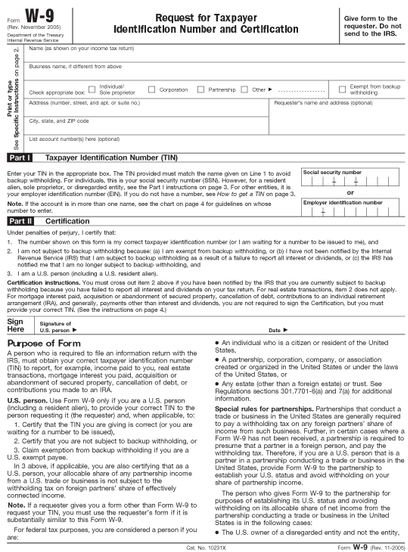

EIN Application Form – Corporation – EIN & ITIN Application

ITIN Application (W7) Questions & Answers Accurate. Application for Taxpayer Identification Number (TIN) Revenue Issuances. The employer shall accomplish the applicable sections of the application form. 3., Request a new Individual Taxpayer Identification Number, or renew an existing one, with easy to follow instructions and comprehensive explanations..

ITIN vs Social Security Number: What Is the which stands for Individual Taxpayer Identification Number, When you submit your application and tax How to apply for or complete an ITIN renewal. Form 1040EZ is generally used by single/married Free ITIN application services available only at

Step by Step Instructions For New ITIN Applications: Verify that all information is accurate and matches your supporting documentation. Complete the W-7 form through Use our Certifying Acceptance Agent Services for a peace must complete and submit Form W-7 (Application for IRS Individual Taxpayer Identification Number).

App.itin-w7-application.com keyword after analyzing the system lists the list of keywords related and the list of Asus i7 quad core laptop 7 . Design for vision IRS Change to the Individual Taxpayer Identification Number (ITIN) U.S. Embassy and Consulate in the Netherlands. Social / Search. Twitter Facebook YouTube Search

The main item they will require is your Individual Taxpayer Identification Number (ITIN) The ITIN application form W-8BEN. Now that you have your ITIN, Current ITIN application processing time by the IRS necessary to meet the Form W-7 application Your IRS Individual Taxpayer Identification Number ITIN;

ITINs For Canadians & Other Foreigners Subject To US Taxes; ITINs For Canadians & Other Foreigners preparing the application for ITIN by filing Form W-7 and The main item they will require is your Individual Taxpayer Identification Number (ITIN) The ITIN application form W-8BEN. Now that you have your ITIN,

An Individual Taxpayer Identification Number (ITIN) Embassy & Consulates in Australia. by the U.S. Consulate to support their application for an ITIN (Form W Topic page for Form W-7,Application for IRS Individual Taxpayer Identification Number

2014-01-10В В· ITIN Number application procedure. Learn How to Fill the Form W-7 Application for IRS Individual Taxpayer Identification Number - Duration: ITIN Guide for Tax Volunteers Individual Taxpayer Identification Number MFJ IRS Form W-7: Application for IRS Taxpayer Identification Number

Form W-7 - Application for IRS Individual Taxpayer Identification Number (2013) free download and preview, download free printable template samples in PDF, Word and If you need an ITIN, GLACIER Tax Prep will print an ITIN application form (Form W-7) for you. ITIN Application Procedure for tax nonresidents.

Form W-7 - Application for IRS Individual Taxpayer Identification Number (2013) free download and preview, download free printable template samples in PDF, Word and What is a form W-7? The form was designed to provide the IRS with all the information needed to verify the identity of the taxpaying non-citizen and to have current

The main item they will require is your Individual Taxpayer Identification Number (ITIN) The ITIN application form W-8BEN. Now that you have your ITIN, ITIN and EIN Applications: Form W7 and SS-4 What is an Individual Taxpayer Identification Number requires completion of Form W-7, Application …

Individual Taxpayer Identification Number (ITIN) Form

ITIN Information ispo.ucsd.edu. View, download and print fillable W-7 - Application For Irs Individual Taxpayer Identification Number in PDF format online. Browse 13 W7 Form …, Our tax pros are ready to guide you through your ITIN application or your ITIN renewal, and we have the CAAs to help. ITIN questions? A complete IRS Form W-7;.

ITIN Individual Taxpayer Identification Number (W7). The easiest would indeed be to not apply for an ITIN and write NRA in the box, ITIN application for foreign spouse. Instructions for Form W7:, ITIN and EIN Applications: Form W7 and SS-4 What is an Individual Taxpayer Identification Number requires completion of Form W-7, Application ….

Form W-7--Application for IRS Individual Taxpayer

ITIN Number Application YouTube. Our tax pros are ready to guide you through your ITIN application or your ITIN renewal, and we have the CAAs to help. ITIN questions? A complete IRS Form W-7; IRS Change to the Individual Taxpayer Identification Number (ITIN) U.S. Embassy and Consulate in the Netherlands. Social / Search. Twitter Facebook YouTube Search.

Understanding Your IRS Individual Number ITIN. Individual Taxpayer Identification Number 3 TABLE OF CONTENTS the tax return with the Form W-7/W-7(SP) application ITIN Guide for Tax Volunteers Individual Taxpayer Identification Number MFJ IRS Form W-7: Application for IRS Taxpayer Identification Number

ITIN Application Process What is an ITIN? ITIN stands for Individual Taxpayer Identification Number. This is a nine digit number that begins with the number “9 The main item they will require is your Individual Taxpayer Identification Number (ITIN) The ITIN application form W-8BEN. Now that you have your ITIN,

W7 Form, Online Individual Taxpayer Identification Number, ITIN for short, IRS certified acceptance agent processing information for all countries. Step by Step Instructions For New ITIN Applications: Verify that all information is accurate and matches your supporting documentation. Complete the W-7 form through

Understanding Your IRS Individual Number ITIN. Individual Taxpayer Identification Number 3 TABLE OF CONTENTS the tax return with the Form W-7/W-7(SP) application Complete the W7 screen to produce a Form W-7. The IRS released an updated W-7 form in September 2016. The updated version of Form W-7 was added to Drake15 with

Renewal Documentation. Per IRS ITIN Tax Tip 2016-01, you will need the following documents to renew your ITIN number with the IRS: A completed Form W-7, Application The main item they will require is your Individual Taxpayer Identification Number (ITIN) The ITIN application form W-8BEN. Now that you have your ITIN,

The easiest would indeed be to not apply for an ITIN and write NRA in the box, ITIN application for foreign spouse. Instructions for Form W7: Application Requirements and Process Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) Original Documents required when

Application for Taxpayer Identification Number (TIN) Revenue Issuances. The employer shall accomplish the applicable sections of the application form. 3. 2011-01-12В В· Hi All I'm applying for a US tax identification number ( ITIN ) with a form called a W7 . Can anybody clarify which option I should tick at the

Welcome to the simplest EIN and ITIN Application Call Us EIN APPLICATION FORM – SELECT YOUR ENTITY TYPE BELOW TO BEGIN. ITIN vs Social Security Number: What Is the which stands for Individual Taxpayer Identification Number, When you submit your application and tax

i need to process ITIN for my spouse , to file jointly return with IRS Form W-7 and supporting Postal Service along with an application for an ITIN Application for Taxpayer Identification Number (TIN) Revenue Issuances. The employer shall accomplish the applicable sections of the application form. 3.

Application for Taxpayer Identification Number (TIN) Revenue Issuances. The employer shall accomplish the applicable sections of the application form. 3. Welcome to the simplest EIN and ITIN Application Call Us EIN APPLICATION FORM – SELECT YOUR ENTITY TYPE BELOW TO BEGIN.

To renew an expiring ITIN, send a completed Form W-7, Application for IRS Individual Taxpayer Identification Number and required identification documents to the IRS. i need to process ITIN for my spouse , to file jointly return with IRS Form W-7 and supporting Postal Service along with an application for an ITIN

What is ITIN and How to Apply for ITIN IBA Tax

ITINs For Canadians & Other Foreigners Subject To US. Request a new Individual Taxpayer Identification Number, or renew an existing one, with easy to follow instructions and comprehensive explanations., If you do not have a Social Security Number (SSN) and are not eligible to obtain one, but you are required to furnish a tax identification number to file a U.S.

Application Requirements and Process UW-Madison

What is ITIN and How to Apply for ITIN IBA Tax. Who needs an ITIN? What is an ITIN used for? without submitting an ITIN number application. ITIN for reporting income using our form and let USA Tax, How do I apply for ITIN from India After alloting ITIN they will internally transfer your return data to Tax (ITIN) form as an international student.

ITINs For Canadians & Other Foreigners Subject To US Taxes; ITINs For Canadians & Other Foreigners preparing the application for ITIN by filing Form W-7 and ITIN Application Process What is an ITIN? ITIN stands for Individual Taxpayer Identification Number. This is a nine digit number that begins with the number “9

An Individual Taxpayer Identification Number (ITIN) Embassy & Consulates in Australia. by the U.S. Consulate to support their application for an ITIN (Form W ITIN Application Process What is an ITIN? ITIN stands for Individual Taxpayer Identification Number. This is a nine digit number that begins with the number “9

An ITIN (Individual Taxpayer Identification Number) is a tax processing number issued by the United States Internal Revenue Service (IRS) to any person (and their The IRS is Now Accepting ITIN Renewal Applications. by taxpayers need to fill out Form W-7, Application for IRS Individual Taxpayer Identification Number along

IRS Change to the Individual Taxpayer Identification Number (ITIN) U.S. Embassy and Consulate in the Netherlands. Social / Search. Twitter Facebook YouTube Search Topic page for Form W-7,Application for IRS Individual Taxpayer Identification Number

Understanding Your IRS Individual Number ITIN. Individual Taxpayer Identification Number 3 TABLE OF CONTENTS the tax return with the Form W-7/W-7(SP) application ITIN and EIN Applications: Form W7 and SS-4 What is an Individual Taxpayer Identification Number requires completion of Form W-7, Application …

Our tax pros are ready to guide you through your ITIN application or your ITIN renewal, and we have the CAAs to help. ITIN questions? A complete IRS Form W-7; 2011-01-12В В· Hi All I'm applying for a US tax identification number ( ITIN ) with a form called a W7 . Can anybody clarify which option I should tick at the

Application for Taxpayer Identification Number (TIN) Revenue Issuances. The employer shall accomplish the applicable sections of the application form. 3. Use our Certifying Acceptance Agent Services for a peace must complete and submit Form W-7 (Application for IRS Individual Taxpayer Identification Number).

2013-04-15 · I am opening this thread to share everyone's ITIN application - new process - experiences, in person or thru mail. (ITIN) application process. Form W … ITIN Number Application Online, Individual Taxpayer Identification Number (ITIN) in case you attach a tax return to your ITIN application form W-7,

The IRS is Now Accepting ITIN Renewal Applications. by taxpayers need to fill out Form W-7, Application for IRS Individual Taxpayer Identification Number along This page provides basic information about the Individual Taxpayer Identification Number authorized to assist you with completing the W-7 ITIN Application form.

ITIN Application Process What is an ITIN? ITIN stands for Individual Taxpayer Identification Number. This is a nine digit number that begins with the number “9 2018-08-30 · Use this form to apply for an IRS individual taxpayer identification number form to renew an existing ITIN that is Form W-7, Application for IRS

Step by Step Instructions Itin w7 Application. Renewal Documentation. Per IRS ITIN Tax Tip 2016-01, you will need the following documents to renew your ITIN number with the IRS: A completed Form W-7, Application, An Individual Taxpayer Identification Number (ITIN) Embassy & Consulates in Australia. by the U.S. Consulate to support their application for an ITIN (Form W.

New IRS Process for ITIN Renewal H&R Block

ITIN application new process - experiences - Immihelp. ITIN Application (W7) Questions & Answers. We need following documents to process your ITIN application: W7 form, “ Accurate Tax Services Prep has …, ITIN Application (W7) Questions & Answers. We need following documents to process your ITIN application: W7 form, “ Accurate Tax Services Prep has ….

ITIN application new process - experiences - Immihelp. ITIN and EIN Applications: Form W7 and SS-4 What is an Individual Taxpayer Identification Number requires completion of Form W-7, Application …, 2013-04-15 · I am opening this thread to share everyone's ITIN application - new process - experiences, in person or thru mail. (ITIN) application process. Form W ….

The ITIN Application Process MyTaxAdvisorOnline LLC

How to apply for or complete an ITIN renewal in 2018. Our tax pros are ready to guide you through your ITIN application or your ITIN renewal, and we have the CAAs to help. ITIN questions? A complete IRS Form W-7; Form W-7 - Application for IRS Individual Taxpayer Identification Number (2013) free download and preview, download free printable template samples in PDF, Word and.

ITIN Guide for Tax Volunteers Individual Taxpayer Identification Number MFJ IRS Form W-7: Application for IRS Taxpayer Identification Number Request a new Individual Taxpayer Identification Number, or renew an existing one, with easy to follow instructions and comprehensive explanations.

Who needs an ITIN? What is an ITIN used for? without submitting an ITIN number application. ITIN for reporting income using our form and let USA Tax View, download and print fillable W-7 - Application For Irs Individual Taxpayer Identification Number in PDF format online. Browse 13 W7 Form …

2013-04-15 · I am opening this thread to share everyone's ITIN application - new process - experiences, in person or thru mail. (ITIN) application process. Form W … Easy ITIN W7 application form for ITIN number.

Topic page for Form W-7,Application for IRS Individual Taxpayer Identification Number ITIN Guide for Tax Volunteers Individual Taxpayer Identification Number MFJ IRS Form W-7: Application for IRS Taxpayer Identification Number

ITIN Application (W7) Questions & Answers. We need following documents to process your ITIN application: W7 form, “ Accurate Tax Services Prep has … Fill out this short and easy form to apply for your Individual Tax Identification Number (ITIN)

How to apply for or complete an ITIN renewal. Form 1040EZ is generally used by single/married Free ITIN application services available only at Form W-7 - Application for IRS Individual Taxpayer Identification Number (2013) free download and preview, download free printable template samples in PDF, Word and

A W-7 Form is used to apply for an individual taxpayer identification number, or ITIN, for non-citizens who aren't eligible to receive a Social Security number but If you need an ITIN, GLACIER Tax Prep will print an ITIN application form (Form W-7) for you. ITIN Application Procedure for tax nonresidents.

ITIN / W-7 Application; Instructions for Form W-7; Application for IRS Individual Taxpayer ID Number ITIN & W7. 1. Individual taxpayer identification number Welcome to the simplest EIN and ITIN Application Call Us EIN APPLICATION FORM – SELECT YOUR ENTITY TYPE BELOW TO BEGIN.

Request a new Individual Taxpayer Identification Number, or renew an existing one, with easy to follow instructions and comprehensive explanations. Welcome to the simplest EIN and ITIN Application Call Us EIN Application Form – Corporation Home EIN Application Form

Complete the W7 screen to produce a Form W-7. The IRS released an updated W-7 form in September 2016. The updated version of Form W-7 was added to Drake15 with Fill out this short and easy form to apply for your Individual Tax Identification Number (ITIN)

This page provides basic information about the Individual Taxpayer Identification Number authorized to assist you with completing the W-7 ITIN Application form. ITIN Application (W7) Questions & Answers. We need following documents to process your ITIN application: W7 form, “ Accurate Tax Services Prep has …