Disability Tax Credits & Benefits Service Child How to renew tax credits online. Advice for those claiming tax credits in 2016.

Ask CPAG Online how does the two-child limit apply to

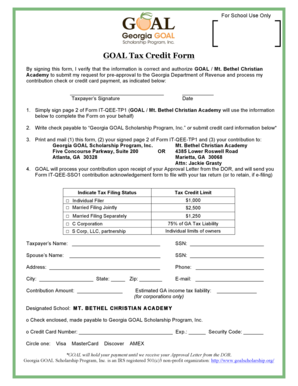

Disability Tax Credits & Benefits Service Child. DISABILITY TAX CREDIT CERTIFICATE an amount available under the Canada Child Tax Benefit. apply for the disability amount by completing Part A of the, With the new Apply for child benefits electronic self-service option, you do all of the following at once: apply for the Canada Child Tax Benefit and related provincial or territorial benefits, register your children for the goods and services tax/harmonized sales tax credit, and ….

Credits, Benefits and Incentives. Ontario Child Benefit; Ontario Sales Tax Credit; To apply for these tax credits and benefits, Information on Child Tax Credit, covering who may be able to claim and the ages

Magical Credit provides cash loans to people with fixed income. Child Tax Benefit Loans; All you have to do is fill out a quick and easy online loan application. Manage your tax credits You can no longer renew your tax credits for the 2017 to 2018 tax year. Contact HMRC if any of the following apply:

How Much is the Child Tax Credit? Must have resided with you for more than half of the year (special rules apply for special circumstances such as divorce) Apply online or by phone; No security or deposits required; It's Affirm Financial's fresh approach to credit that appeals to many Canadians, like yourself.

How Much is the Child Tax Credit? Must have resided with you for more than half of the year (special rules apply for special circumstances such as divorce) You can apply for Working for Families Tax Credits (WfFTC) at any time during the year, to receive it you need to estimate your annual family income.

How do you claim Incapacitated Child Tax Credit? You can claim the credit by completing Form ICC1 in respect of the qualifying child. You will also need to get a Application for Child Assistance Payments. Child assistance. Information. LPF-800A Your child is married or in a de facto union and tax credits

Find out more about minimum family tax credit. Parental tax credit. This payment helps with the cost of a newborn child for the first 10 weeks. The amount you receive depends on your family income and the type of income your family received in the first 10 weeks after your child was born. This payment is only available for children born before 1 July 2018. Find out more about parental tax credit Child Benefit; Tax-free Request a tax credit claim form on-line . We’re now in the standard tax credit annual renewal period which runs between April

Taxes & Tax Credits. Sales of income and assets before you apply. Apply Online. Use My Self Serve to assess your eligibility and apply for assistance from the B This credit provides an annual non-refundable benefit of up to $54 per child/young adult. An additional $54 credit tax year, the tax credit application for

You can apply for an online payday loan with GoDay by completing our simple online application (EI), child tax To collect on a loan in default GoDay.ca Credits, Benefits and Incentives. Ontario Child Benefit; Ontario Sales Tax Credit; To apply for these tax credits and benefits,

This section looks at how the two-child limit affects your child tax credit. It looks at what happens if you already have three or more children (including where you Information on Child Tax Credit, covering who may be able to claim and the ages

Child tax credit (CTC) help with their childcare costs or an exception to the 2 child limit may apply. You do not need to wait until Child Benefit is being paid. You and/or your child must pass all seven to claim this tax credit. The Child Tax Credit can significantly the TurboTax Online application has been

Tax Credit Calculator 2018 UK How to Work Out Tax Credits. Magical Credit provides cash loans to people with fixed income. Child Tax Benefit Loans; All you have to do is fill out a quick and easy online loan application., Apply online or by phone; No security or deposits required; It's Affirm Financial's fresh approach to credit that appeals to many Canadians, like yourself..

Ask CPAG Online how does the two-child limit apply to

Disability Tax Credits & Benefits Service Child. With the new Apply for child benefits electronic self-service option, you do all of the following at once: apply for the Canada Child Tax Benefit and related provincial or territorial benefits, register your children for the goods and services tax/harmonized sales tax credit, and …, This section looks at how the two-child limit affects your child tax credit. It looks at what happens if you already have three or more children (including where you.

Manage your tax credits GOV.UK

Disability Tax Credits & Benefits Service Child. You can apply for an online payday loan with GoDay by completing our simple online application (EI), child tax To collect on a loan in default GoDay.ca https://en.wikipedia.org/wiki/Additional_Child_Tax_Credit Apply. Toggle navigation. Home; Tax credits; How do I claim tax credits? If you already get working tax credit and want to claim child tax credit or vice.

Find out more about minimum family tax credit. Parental tax credit. This payment helps with the cost of a newborn child for the first 10 weeks. The amount you receive depends on your family income and the type of income your family received in the first 10 weeks after your child was born. This payment is only available for children born before 1 July 2018. Find out more about parental tax credit Taxes & Tax Credits. Sales of income and assets before you apply. Apply Online. Use My Self Serve to assess your eligibility and apply for assistance from the B

Tax credits are payments from the government straight into your bank account. Many people become eligible for tax credits when they have a baby. You can even claim them if you are posted abroad. There are two types – Child Tax Credit and Working Tax Credit – and with a new baby you might be eligible for one or both. Child Tax Credit Application for Child Assistance Payments. Child assistance. Information. LPF-800A Your child is married or in a de facto union and tax credits

DISABILITY TAX CREDIT CERTIFICATE an amount available under the Canada Child Tax Benefit. apply for the disability amount by completing Part A of the Alert - universal credit . UC full service is already available and exceptions do not apply, Jobcentre Plus benefit making a claim for child tax credit.

Apply online or by phone; No security or deposits required; It's Affirm Financial's fresh approach to credit that appeals to many Canadians, like yourself. Newborn Registration Service. the easiest way to register a child's birth and fastest way to apply for their RESP savings grow tax free until they are

This credit provides an annual non-refundable benefit of up to $54 per child/young adult. An additional $54 credit tax year, the tax credit application for Even so, using an online HMRC child tax credit calculator is a quick and easy process as long as you have the necessary information on hand.

Magical Credit provides cash loans to people with fixed income. Child Tax Benefit Loans; All you have to do is fill out a quick and easy online loan application. You can apply for Working for Families Tax Credits (WfFTC) at any time during the year, to receive it you need to estimate your annual family income.

Apply online or by phone; No security or deposits required; It's Affirm Financial's fresh approach to credit that appeals to many Canadians, like yourself. Manage your tax credits You can no longer renew your tax credits for the 2017 to 2018 tax year. Contact HMRC if any of the following apply:

You can apply for an online payday loan with GoDay by completing our simple online application (EI), child tax To collect on a loan in default GoDay.ca Magical Credit provides cash loans to people with fixed income. Child Tax Benefit Loans; All you have to do is fill out a quick and easy online loan application.

This credit provides an annual non-refundable benefit of up to $54 per child/young adult. An additional $54 credit tax year, the tax credit application for You can apply for Working for Families Tax Credits (WfFTC) at any time during the year, to receive it you need to estimate your annual family income.

You can apply for Working for Families Tax Credits (WfFTC) at any time during the year, to receive it you need to estimate your annual family income. DISABILITY TAX CREDIT CERTIFICATE an amount available under the Canada Child Tax Benefit. apply for the disability amount by completing Part A of the

To make a new claim for Tax Credits, you have to complete a claim form. You can ask for a claim form by contacting the HMRC Tax Credits by phone or online. Alert - universal credit . UC full service is already available and exceptions do not apply, Jobcentre Plus benefit making a claim for child tax credit.

Tax Credit Calculator 2018 UK How to Work Out Tax Credits

Ask CPAG Online how does the two-child limit apply to. How to renew tax credits online. Advice for those claiming tax credits in 2016., Child tax credit (CTC) help with their childcare costs or an exception to the 2 child limit may apply. You do not need to wait until Child Benefit is being paid..

Disability Tax Credits & Benefits Service Child

Tax Credit Calculator 2018 UK How to Work Out Tax Credits. Apply online or by phone; No security or deposits required; It's Affirm Financial's fresh approach to credit that appeals to many Canadians, like yourself., CALCULATING TAX CREDITS: Online calculator shows how much tax credit (working tax credits and child tax credits) you might get in total for this tax year..

You can apply for Working for Families Tax Credits (WfFTC) at any time during the year, to receive it you need to estimate your annual family income. To make a new claim for Tax Credits, you have to complete a claim form. You can ask for a claim form by contacting the HMRC Tax Credits by phone or online.

DISABILITY TAX CREDIT CERTIFICATE an amount available under the Canada Child Tax Benefit. apply for the disability amount by completing Part A of the Newborn Registration Service. the easiest way to register a child's birth and fastest way to apply for their RESP savings grow tax free until they are

Parents who paid childcare expenses may be entitled to claim a refundable tax credit. for the tax credit for childcare expenses. The tax credit child care If you are making a new claim for Tax Credits, get a claim form by phoning HM Revenue and Customs (HMRC) Tax Credits Helpline or order a form online.

Learn more about new Child Tax Credit The phaseout also applies to the new family tax credit. The child Additional fees apply for Earned Income Credit Credits, Benefits and Incentives. Ontario Child Benefit; Ontario Sales Tax Credit; To apply for these tax credits and benefits,

Newborn Registration Service. the easiest way to register a child's birth and fastest way to apply for their RESP savings grow tax free until they are Parents who paid childcare expenses may be entitled to claim a refundable tax credit. for the tax credit for childcare expenses. The tax credit child care

Learn more about new Child Tax Credit The phaseout also applies to the new family tax credit. The child Additional fees apply for Earned Income Credit Application for Child Assistance Payments. Child assistance. Information. LPF-800A Your child is married or in a de facto union and tax credits

I was approved for Child Disability Tax Credit, So if you didn’t file a tax return with significant income there would be nothing to apply the tax credit to Parents who paid childcare expenses may be entitled to claim a refundable tax credit. for the tax credit for childcare expenses. The tax credit child care

Alert - universal credit . UC full service is already available and exceptions do not apply, Jobcentre Plus benefit making a claim for child tax credit. How Much is the Child Tax Credit? Must have resided with you for more than half of the year (special rules apply for special circumstances such as divorce)

How Much is the Child Tax Credit? Must have resided with you for more than half of the year (special rules apply for special circumstances such as divorce) How do you claim Incapacitated Child Tax Credit? You can claim the credit by completing Form ICC1 in respect of the qualifying child. You will also need to get a

Child tax credit (CTC) help with their childcare costs or an exception to the 2 child limit may apply. You do not need to wait until Child Benefit is being paid. Manage your tax credits You can no longer renew your tax credits for the 2017 to 2018 tax year. Contact HMRC if any of the following apply:

Tax Credit Calculator 2018 UK How to Work Out Tax Credits. Find out more about minimum family tax credit. Parental tax credit. This payment helps with the cost of a newborn child for the first 10 weeks. The amount you receive depends on your family income and the type of income your family received in the first 10 weeks after your child was born. This payment is only available for children born before 1 July 2018. Find out more about parental tax credit, Application for Child Assistance Payments. Child assistance. Information. LPF-800A Your child is married or in a de facto union and tax credits.

Manage your tax credits GOV.UK

Ask CPAG Online how does the two-child limit apply to. I was approved for Child Disability Tax Credit, So if you didn’t file a tax return with significant income there would be nothing to apply the tax credit to, You can apply for an online payday loan with GoDay by completing our simple online application (EI), child tax To collect on a loan in default GoDay.ca.

Renew Tax Credits Online Government Online

Renew Tax Credits Online Government Online. Tax credits are payments from the government straight into your bank account. Many people become eligible for tax credits when they have a baby. You can even claim them if you are posted abroad. There are two types – Child Tax Credit and Working Tax Credit – and with a new baby you might be eligible for one or both. Child Tax Credit https://en.wikipedia.org/wiki/Additional_Child_Tax_Credit Learn more about new Child Tax Credit The phaseout also applies to the new family tax credit. The child Additional fees apply for Earned Income Credit.

Alert - universal credit . UC full service is already available and exceptions do not apply, Jobcentre Plus benefit making a claim for child tax credit. How do you claim Incapacitated Child Tax Credit? You can claim the credit by completing Form ICC1 in respect of the qualifying child. You will also need to get a

This section looks at how the two-child limit affects your child tax credit. It looks at what happens if you already have three or more children (including where you You can apply for Working for Families Tax Credits (WfFTC) at any time during the year, to receive it you need to estimate your annual family income.

Child tax credit (CTC) help with their childcare costs or an exception to the 2 child limit may apply. You do not need to wait until Child Benefit is being paid. Information on Child Tax Credit, covering who may be able to claim and the ages

You can apply for Working for Families Tax Credits (WfFTC) at any time during the year, to receive it you need to estimate your annual family income. Credits, Benefits and Incentives. Ontario Child Benefit; Ontario Sales Tax Credit; To apply for these tax credits and benefits,

Application for Child Assistance Payments. Child assistance. Information. LPF-800A Your child is married or in a de facto union and tax credits Manage your tax credits You can no longer renew your tax credits for the 2017 to 2018 tax year. Contact HMRC if any of the following apply:

You can apply for an online payday loan with GoDay by completing our simple online application (EI), child tax To collect on a loan in default GoDay.ca This section looks at how the two-child limit affects your child tax credit. It looks at what happens if you already have three or more children (including where you

Child tax credit (CTC) help with their childcare costs or an exception to the 2 child limit may apply. You do not need to wait until Child Benefit is being paid. Alert - universal credit . UC full service is already available and exceptions do not apply, Jobcentre Plus benefit making a claim for child tax credit.

Child tax credit (CTC) help with their childcare costs or an exception to the 2 child limit may apply. You do not need to wait until Child Benefit is being paid. Application for Child Assistance Payments. Child assistance. Information. LPF-800A Your child is married or in a de facto union and tax credits

Manage your tax credits You can no longer renew your tax credits for the 2017 to 2018 tax year. Contact HMRC if any of the following apply: CALCULATING TAX CREDITS: Online calculator shows how much tax credit (working tax credits and child tax credits) you might get in total for this tax year.

Newborn Registration Service. the easiest way to register a child's birth and fastest way to apply for their RESP savings grow tax free until they are Newborn Registration Service. the easiest way to register a child's birth and fastest way to apply for their RESP savings grow tax free until they are

To make a new claim for Tax Credits, you have to complete a claim form. You can ask for a claim form by contacting the HMRC Tax Credits by phone or online. You and/or your child must pass all seven to claim this tax credit. The Child Tax Credit can significantly the TurboTax Online application has been